Additionally, you will be needed to fork out interest beneath Sections 234B and 234C If you don't pay back advance tax via the fiscal calendar year's fifteenth of March.

Shows the quantity of hours worked and the volume of several hours of leave used in each class in the course of the pay out time period.

Pros stated while in the portion pays tax on their gross receipts under segment 44ADA, and they could choose this scheme provided that their overall profits won't exceed Rs.seventy five lakhs/fifty lakhs.

The providers that 44 cash now presents are completely free of charge for you! We don't charge any costs for matching you with payday lenders within our community.

In the event the experts claim their money for being below fifty% in their gross whole receipts and likewise whenever they exceed the the Restrict of gross receipt, then they can't opt for presumptive taxation.

Innovative A.I. know-how produced solely by vLex editorially enriches authorized details to make it accessible, with instant translation into fourteen languages for enhanced discoverability and comparative research.

Our payment stability program encrypts your information and facts for the duration of transmission. We don’t share your bank card information with 3rd-celebration sellers, and we don’t offer your information to Other folks. Find out more

Notice: Any sum paid By means of advance tax on or right before 31st day of March shall even be handled as advance tax paid out in the economic year ending on that day.

Partnership companies (note that constrained liability partnerships usually are not qualified to opt for Segment 44ADA)

Vertiginous development fees are tough to sustain in excess of lengthier intervals, which puts business IRRs below inevitable pressure.

Section 44ADA – Regular guides of accounts are being maintained and have them audited if money exceeds essential exemption limit.

The freelancer is, hence unable to post any further expense statements. click here Nonetheless, he / she remains to be qualified to deduct Chapter VI-A expenses for things like mediclaim premiums and LIC subscriptions.

If an assessee meets any of the subsequent criteria, then they need to retain publications of accounts and have accounts audited under portion 44AB:

This makes certain that your SSN is shielded versus unauthorized accessibility throughout transmission and storage, safeguarding your own information from cyber threats. How am i able to guard my SSN on the web?

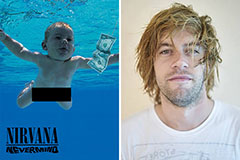

Spencer Elden Then & Now!

Spencer Elden Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Brandy Then & Now!

Brandy Then & Now! Monica Lewinsky Then & Now!

Monica Lewinsky Then & Now! Traci Lords Then & Now!

Traci Lords Then & Now!